How to Invest in the Best Carbon Credit Exchange Stocks

admin

- 0

Best Carbon Credit Exchange Stocks

The world’s transition away from carbon-intense power generation is a long process, and many people are looking for ways to participate in it. Carbon credits are one way to do that, and a growing number of companies are buying them to offset their own emissions. Investing in carbon credit exchange stocks is another way to get involved, and while this type of investment may not provide quick or massive returns, it can be an excellent way to support climate change initiatives.

There are several different ways to invest in carbon credit ETFs, but the most accessible is to buy shares directly through a brokerage account. These funds track the performance of carbon-credit futures contracts, and they can be traded just like any other stock. This is considered to be a more diversified strategy than investing in individual carbon-credit stocks, which can have more volatile prices.

To purchase shares in a carbon credit exchange, you will need to open a brokerage account or log into your existing one and search for the appropriate ticker symbol. Once you have done that, you can start investing for as little as the price of a single share. It is important to remember that carbon-credit investments are still relatively new and can be very volatile. As such, you should only invest a portion of your portfolio in them.

How to Invest in the Best Carbon Credit Exchange Stocks

The largest carbon credit ETF is called KraneShares Global Carbon Strategy ETF (KRBN). This fund was launched in September 2019, and it currently holds more than $1 billion in assets. The fund invests in futures contracts in both the United States and Europe, and it has a relatively low correlation with other types of investments. Its expense ratio is also on the higher end for an ETF at 0.78%.

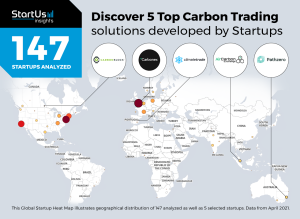

Xpansiv CBL and ACX are two of the largest carbon credit trading platforms in the world. They are both trying to simplify and speed up the trade of carbon credits by creating standard products, which ensure certain basic specifications are respected. For example, a carbon credit bought on the Xpansiv CBL platform will be guaranteed to come from a reforestation project that meets certain criteria.

Microsoft is also a major player in the carbon-credit market, and it has ambitious targets for cutting its own emissions. It wants to be carbon-negative by 2050, and it is already purchasing credits to offset its historical emissions. This shows how big corporations are starting to look for ways to be more environmentally responsible.

If you’re a beginner in the carbon-credit market, it’s best to stick with ETFs and ETNs that are tracking the performance of futures contracts. This is a more diversified approach to the carbon-credit market, and it will give you a better chance of making good money over time. However, you should also keep in mind that the market is very volatile, and it’s prone to changes in policy. This can mean large swings in the value of your investments, so you should always research thoroughly before investing.